Down in choppy overnight trade.

News:

For anyone who wondered just how the VIX could be up a stunning 9% yesterday as equities surged, the most interesting thing I've read in the past 24 hours was from Charlie McElligott, Head of US Cross-Asset Strategy at RBC Capital Markets in New York, via Zero Hedge.

Here Is The "Catalyst" For The Market's Inexplicable Surge: A $17 Billion Trade Gone Wrong

Sounds like a "hedged futures" fund that specialized in selling volatility premium on the S&P ended up decidedly unhedged (zero hedged?) to the tune of $17 billion coming into this Friday's options expiration.

So what we saw this week was most likely forced buying rather than natural buying, which could explain the weak internals, and which means it can unwind in an instant.

But probably not until after expiration, however.

There is a time & place for big short premium bets, and now isn't it.

Selling premium is best done in periods of high implied volatility (over 45%), and definitely not when the VIX is pushing single digits.

SPX IV is 15%.

This trade-gone-wrong is great example why short gamma -- the speed of the delta -- too close to expiry is like throwing gasoline on a fire.

Right on time, whether he realizes it or not, Tastytrade's Tom Sosnoff had a Bernard Baruch moment recently. While going through TSA airport security the other day, he was pulled aside for a "search." As soon as they were out of earshot of the others, the TSA guy said, "We killed it with NVDA yesterday." Fist pump.

Feels like there is an enormous new group of premium sellers out there that have never faced unlimited risk during a flash crash, a historic correction, or a "large, adverse shock" that Janet Yellen is so fond of mentioning over and over.

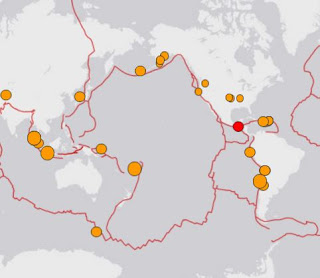

If they want to play with fire, maybe the Ring Of Fire (below) has a message for them.

Elsewhere, housing permits rose, housing starts dropped, and the Phily Fed index soared 83% from 23.6 to 43.3. That's hot.

FX:

CHF & JPY are the big movers thus far, and they're bid.

Bitcoin up over 1%.

Treasuries:

Volume blew out along with falling prices two days in a row. Let's see what kind of rally can ensue.

Energy:

WTI crude still hanging tough. NG still banging lows.

Metals:

Everything shiny has perked up thus far, while copper is flashing red.

S&P Outlook:

Risky Business:

Careful, Mr. President.

Somehow the Ring Of Fire is staring to feel like a metaphor for "something's coming."

|

| Source: USGS |

Maybe this week was a wrong-sided short vol fund instead of a loco market. Maybe not.

All I care about now is that the S&P stopped in the middle of a Fib zone cited yesterday on Twitter: 2348.03-2352.77.

Areas below to test might be 2335, and I still like 2315-2325. Higher up there is a 1:1 Fib extension taken from the 2009 lows that targets 2363.11.

Above that is 2373.89-2379.39.

Sounds like that fund is still in trouble and the market could inflict further pain until Friday. But plenty of pain could be inflicted lower too, should the market choose. Still prefer to wait for something to break first before placing a big bet against it.

Got some SDS. Got some SSO. Got a lot of patience.

No comments:

Post a Comment