S&P E-mini Futures:

Down from yesterday's strong close.

News:

Competing social mood cues are still in force.

Such mixed mood is probably the result of the illusion of centrally managed markets by global central bankers, and why they are doomed to failure.

Bull just beginning:

Bull close to ending:

Just plain bull:

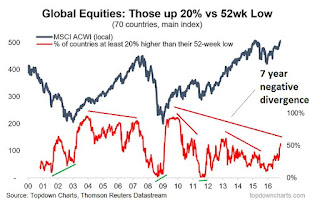

Take a good look at that chart. There is divergence all over it. See it?

Here are my mark ups. Green for positive divergence. Red for negative divergence.

Stocks are about to get the seven-year itch.

Meanwhile, four Fed Speakers are scheduled today, ostensibly to make sure it doesn't happen.

FX:

Heard it yet again, from the same celebrity trader, for the third time in two years, that the US dollar is toast!

I too am concerned at this time, but the dollar has yet to break a swing point, major or minor. The first minor one being 100.73 on the DXY (100.63 on DX futures). Currently the dollar is catching a nice bid above these levels.

There is a 1:1 Fib extension target at DXY 100.43. That could be a target. But the major swing point is DXY 99.43 (DX 99.49). That would start to get my attention.

I am on record here that if the dollar does fail, if it is actually forming a large multi-decade falling wedge, the target would be "below 70."

Meanwhile, back to today, CHF and JPY are ripping. Possible Risk Off warning.

Treasuries:

Three days worth of topping tails as prices attempt to rally from their respective triangles. Not very consoling to those thinking prices bottomed.

Hearing a ton of people going against over three decades of price history proclaiming that rising bond prices mean falling stock prices.

Bond prices bottomed in 1981 and have been in an uptrend along with stocks -- with few exceptions -- ever since. Suddenly stocks will tank from higher bond prices?

In our newfangled credit-based economy, rising yields will tank the market. Bill Gross says 2.60% on the 10-yr will to do it. Jeff Gundlach says 3.00% is the level.

Regardless who is right, they're both saying the same thing.

Energy:

WTI crude and NG are ripping. 49.95 held but WTI will need more volume.

Metals:

Gold is leaking open interest as it rallies. Silver is red thus far today. Copper & the P's are up strongly.

S&P Outlook:

2264.06 was broken yesterday and it didn't matter. The market turned and ripped.

Confidence in the wave count targeting higher prices is elevated, but it could be a messy run.

Gaps at 2257.83 and 2238.83 and the volume shelf at the 2250 are still viable targets.

No comments:

Post a Comment